rhode island income tax withholding

Employees exempt from federal tax withholding. The income tax wage table has changed.

How Is Tax Liability Calculated Common Tax Questions Answered

The annualized wage threshold where the annual exemption amount is eliminated has increased from 227050 to 231500.

. In ADV 2021-11 the Rhode Island Division of Taxation announced that it has extended through July 17 2021 previously extended through May 18 2021 emergency regulations that temporarily waive the requirement that employers withhold Rhode Island state income tax from the wages of. A resident is defined as anyone who is domiciled in the state or who spends. Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax.

The annualized wage threshold where the annual exemption amount is eliminated has changed from 234750 to 241850. A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1. Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis.

With online registration it can take up to 4 weeks. Rhode Island Division of Taxation. For more information on Nonresident Real Estate Withholding see Withholding Tax on the Sale of Real Property by Nonresidents 280-RICR-20-10-1.

No action on the part of the employee or the personnel office is necessary. July 12 2022 According to a signed plea agreement filed today in US. A personal income tax is imposed for each taxable year.

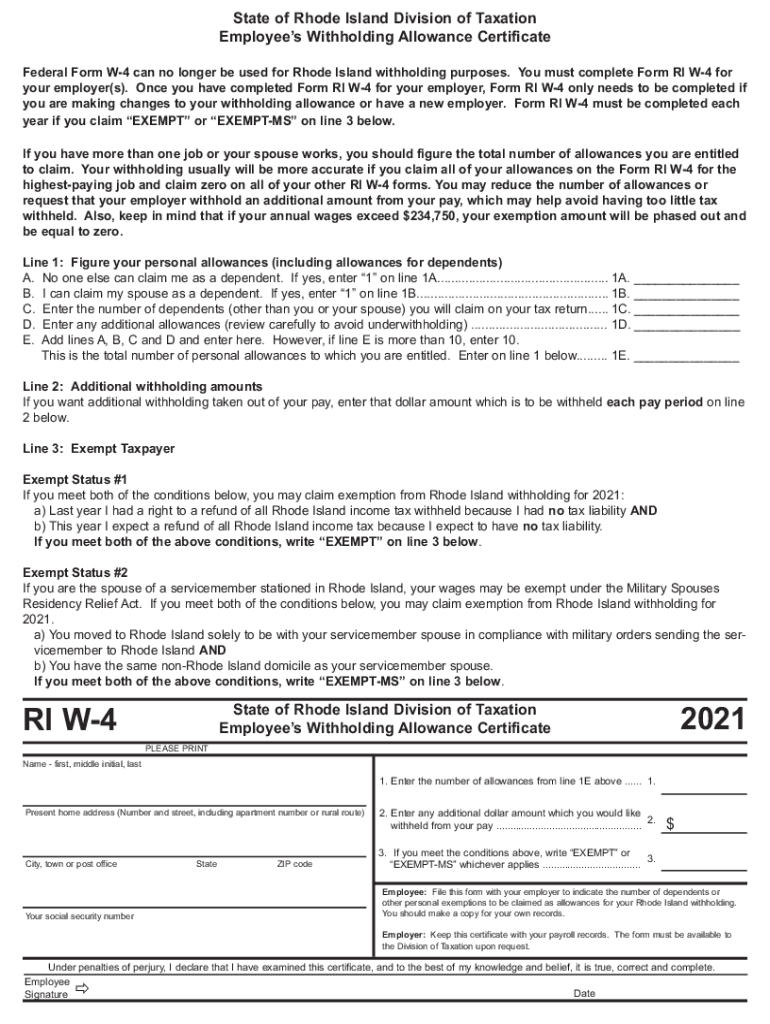

Employees must require employees submit state Form RI W-4 if hired in 2020 or when making withholding tax changes in 2020. You set up your account by registering your business with the DOT online or on paper. The Rhode Island Division of Taxation has released the state income tax withholding tables for tax year 2020.

The income tax wage table has been updated. If you do not have a RI location print the form and mail it in with applicable fees Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax Only the registration for the permit. Guide to tax break on pension401kannuity income.

The income tax withholding for the State of Rhode Island includes the following changes. Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now. Employers withholding Rhode Island personal income tax from employees wages must report and pay the taxes withheld to the Division of Taxation on a periodic basis depending upon the amount of withholding made from employees wages.

The income tax is progressive tax with rates ranging from 375 up to 599. REPORTING RHODE ISLAND TAX WITHHELD. To receive free tax news updates send an e-mail with SUBSCRIBE in subject line.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. District Court in Providence a Rhode Island woman who it is alleged falsely claimed to be a cancer-stricken US.

Up to 25 cash back Apart from your EIN you also need to establish a Rhode Island withholding tax account with the Rhode Island Department of Taxation DOT. If you are not ready to transition to the Tax Portal we also support various legacy. One Capitol Hill Providence RI 02908.

Forms Toggle child menu. Laws 44-30-71c electronic payment of withholding tax is required for employers who are. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf.

Marine decorated with the Purple Heart and Bronze Star and who allegedly used those claims to fraudulently gain hundreds of thousands of dollars in charitable benefits and. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. If you have any questions or need additional information call 401 574-8829 option 4 or email TaxNonRes713taxrigov.

The rates range from 375 to 599. Quarter-monthly Form 941-QM-RI within 3 banking days after the last day of the quarter-monthly period if employer withholds 600 or more but less than 24000 per month. Additionally employers in other states may wish to withhold Rhode Island personal income tax from wages of their Rhode Island employees as a convenience to those employees.

Subscribe for tax news. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. No action on the part of the employee or the personnel office is necessary.

If you need help getting started feel free to call us at 4015748484 or email at taxportaltaxrigov. Withholding Tax Filing Due Date Calendar 2021 2021 Withholding Tax Filing Due Date Calendar PDF file less than 1. What you need to know.

The additional amount of Rhode Island income tax withholding is entered on line 2 of Form RI W-4. The supplemental withholding rate for 2020 continues at 599. Permit to make sales at retail.

The following rules apply in Rhode Island. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI. To register online use the DOTs Combined Online Registration Service.

We allow for estimated payments extension payments payments with a tax filing license renewal payments bill payments and payments for various fees. Employers are not required to determine the correctness of the withholding allowance certificates and may rely on the number of state withholding exemptions claimed on the RI W-4 by the employee. It should take one to three weeks for your refund check to be processed after your income tax return is recieved.

Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax Only the registration for the permit to make sales at retail including litter fee cigarette license require. Residents and nonresidents including resident and nonresident estates and trusts are required to pay estimated taxes for. The income tax withholding for the State of Rhode Island includes the following changes.

Now that were done with federal income taxes lets tackle Rhode Island state taxes. The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the difference.

WEEKLY - If the employer withholds 600 or more for a calendar month from employees wages the employer must remit. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. Rhode Island State Payroll Taxes.

Up to 10 cash back Employers in Rhode Island must conform with these state rules relating to filing income tax withholding returns. Rhode Island Division of Taxation One Capitol Hill Providence RI 02908. The state has a progressive income tax broken down into three tax brackets meaning the more money your employees make the higher the income tax.

Rhode Island extends COVID-19 income tax withholding guidance for teleworkers. 2021 Employers Income Tax Withholding Tables PDF file less than 1 mb megabytes.

Ri Ri W 4 2021 2022 Fill And Sign Printable Template Online

Bulletin On Passthrough Entities To Non Resident Taxpayers Ri Division Of Taxation

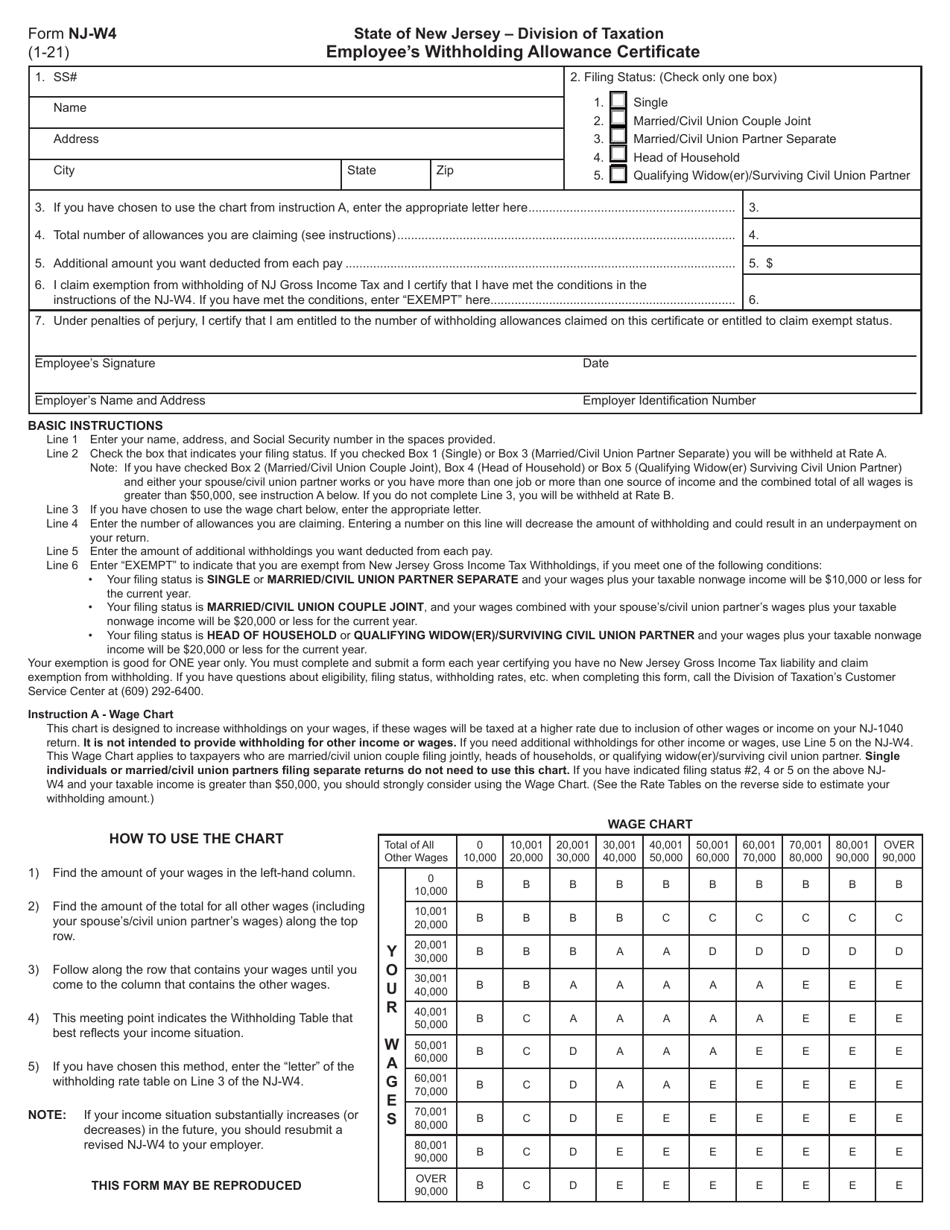

Form Nj W4 Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate New Jersey Templateroller

Form 660 Download Fillable Pdf Or Fill Online Certificate Of Cancellation For Nonresident Landlord Rhode Island Templateroller

2022 Rhode Island State Federal Labor Law Posters National Safety Compliance

Tax Assistance Mercer County Library System

Income Withholding For Support Pdf Fpdf Docx Iowa

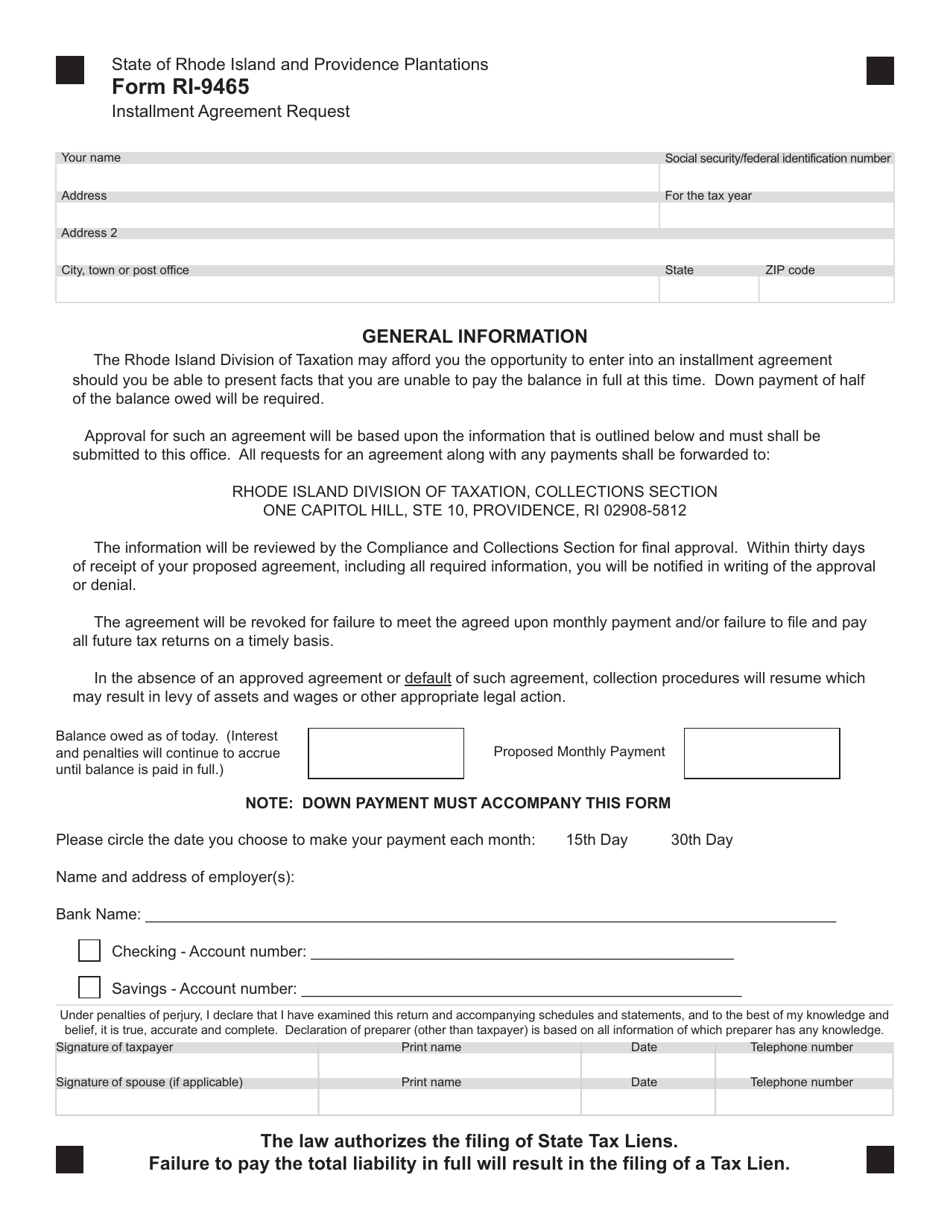

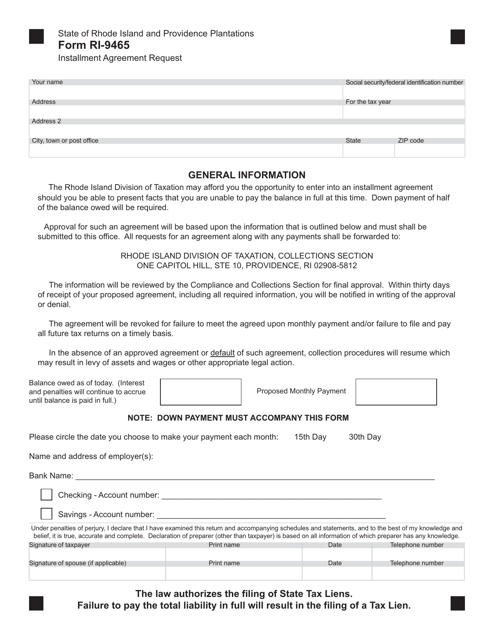

Form Ri 9465 Download Printable Pdf Or Fill Online Installment Agreement Request Rhode Island Templateroller

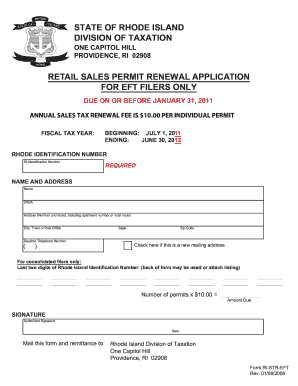

Rhode Island Retail Sales Permit Fill Out And Sign Printable Pdf Template Signnow

Rhode Island State Tax Tables 2022 Us Icalculator

Form Ri 9465 Download Printable Pdf Or Fill Online Installment Agreement Request Rhode Island Templateroller

Navigating State Withholding Requirements For Nonresident Employees Wolters Kluwer

How Is Tax Liability Calculated Common Tax Questions Answered

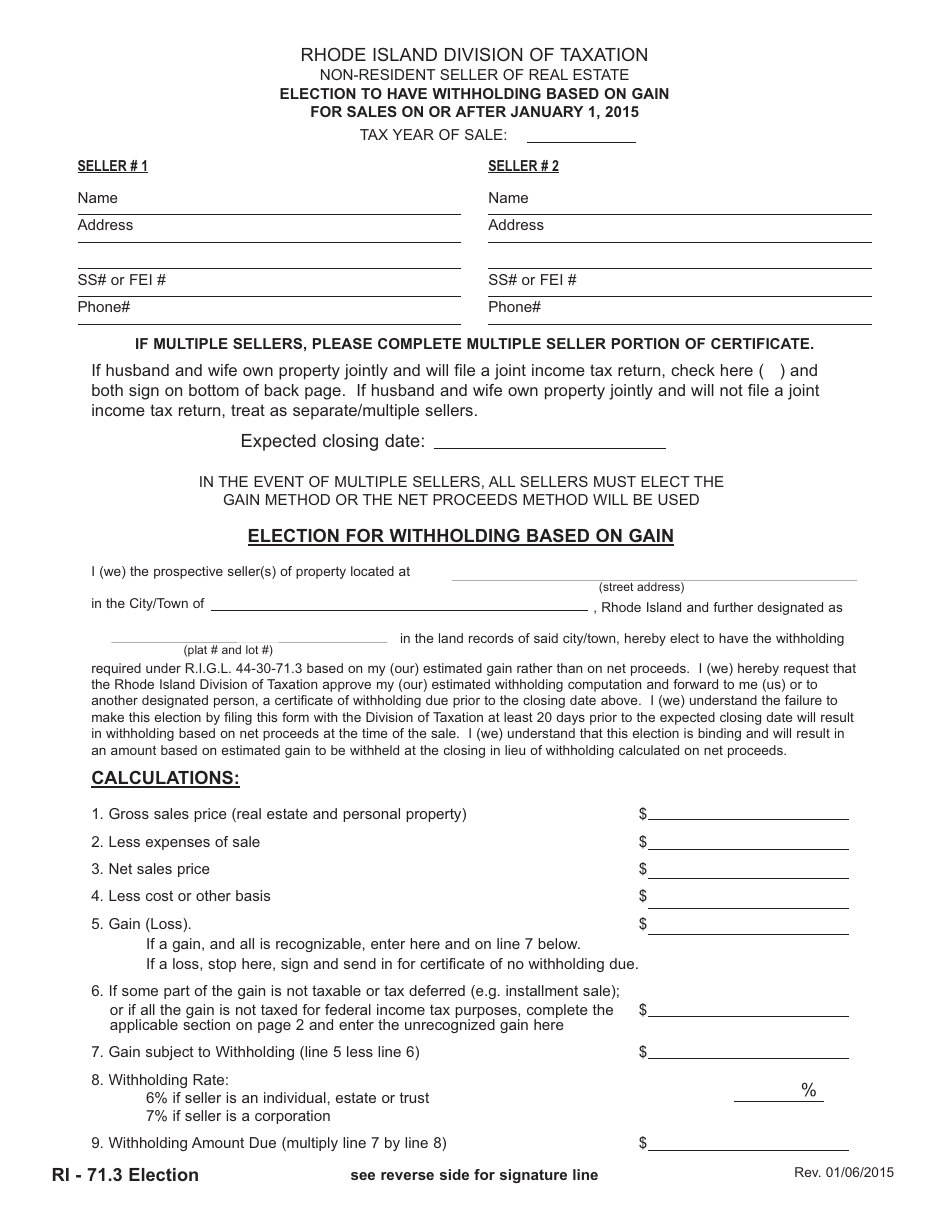

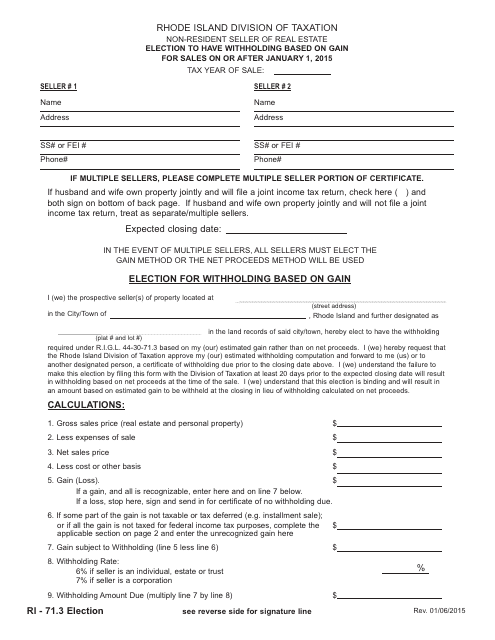

Rhode Island Non Resident Seller Of Real Estate Election To Have Withholding Based On Gain For Sales On Or After January 1 2015 Download Printable Pdf Templateroller

Rhode Island Non Resident Seller Of Real Estate Election To Have Withholding Based On Gain For Sales On Or After January 1 2015 Download Printable Pdf Templateroller

2022 Rhode Island State Federal Labor Law Posters National Safety Compliance